Executive Compensation System

Advantest's executive compensation system consists of fixed compensation (monetary), performance-linked bonuses (monetary), and stock compensation (non-monetary). The Nomination and Compensation Committee proposes our executive compensation system to the Board of Directors, which is operated following approval by the Board of Directors and the General Meeting of Shareholders.

Basic Concept of the Executive Compensation System

The basic concept of the executive compensation system is as follows.

- Establish a compensation mix and level that attracts international human resources who can support our global business development

In order to continue growing in the semiconductor industry, which is complex and swiftly-evolving on a global level, we will appoint talented human resources from all over the world and compensate them according to global standards. - Well-balanced bonuses linked to performance

Given that Advantest's business performance fluctuates, we will reward the contribution of officers when business performance is good, and reduce the burden on our company when business performance is declining. - Stock compensation that encourages executives to share the shareholder perspective and promotes a medium/long-term perspective on management

We combine restricted stock compensation (RS), which encourages executives to pursue the medium/long-term corporate value improvement that shareholders desire, and performance share unit compensation (PSU), which encourages the achievement of medium-term management goals that lead to the improvement of corporate value.

Compensation Structure

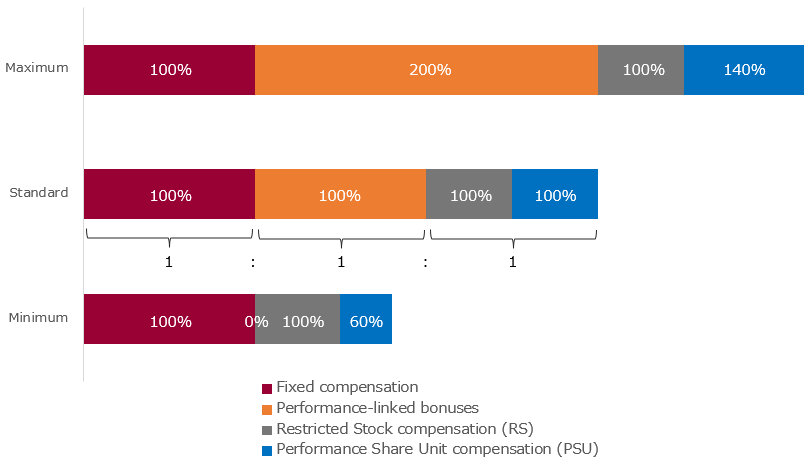

As the ratio fluctuates depending on business performance, the ratio of remuneration is as follows, using standard remuneration as an example. However, if s/he concurrently serves as a director, director remuneration will be paid separately.

| Senior Executive Officers (including the president) |

Fixed compensation: performance-linked bonuses: stock compensation = approximately 1:1:1 |

|---|---|

| Other Executive Officers | Fixed compensation: performance-linked bonuses: stock compensation = approximately 1:0.8:0.8 |

Fixed Compensation

Fixed Compensation (cash compensation) for the Directors and Executive Officers (including the president) shall be set at an appropriate level according to individual duties and responsibilities, and will be paid monthly, with reference to external objective data.

Performance-linked Bonuses

Advantest believes that performance-linked bonuses for the Directors and Executive Officers (including the president) should improve corporate value by increasing the range of linkage.

Performance-linked bonuses are short-term incentives for the results of a single year, and are paid once a year after the performance of the Advantest Group for the relevant business year is confirmed. The distribution according to performance indicators and individual evaluations is as follows:

| Performance indicators | With the annual profit plan target achievement rate as a KPI, bonuses vary from 0% to 200% of the individual's standard amount. * The standard amount of Senior Executive Officers is 100% of fixed compensation. The standard amount of other Executive Officers is 80% of fixed compensation. |

|---|---|

| Individual evaluation |

Up to 30% of the total amount of performance-linked bonuses for executive officers is redistributed based on individual evaluations conducted by the president. Evaluation and redistribution proposals are discussed and approved by the Nomination and Compensation Committee and reported to the Board of Directors. In principle, the president's performance-linked bonus is calculated based on the results of performance indicators, but if the Board of Directors deems it necessary and clearly states their reasoning, it may be increased or decreased. |

Stock Compensation

As far as stock compensation for the Directors and Executive Officers (including the president) is concerned, in order to encourage in order to encourage management from a medium/long-term perspective, we have introduced a restricted stock compensation plan (RS), which is granted on the condition that the company holds shares during the term of office, and performance share unit compensation plan (PSU), which is based to the achievement status of the mid-term management plan.

Restricted Stock compensation (RS)

- 50% of stock compensation for the Directors and Executive Officers (including the president) is RS.

- It is granted every year, with restrictions on transfer during the recipient's term of office (obligation to continue holding).

Performance Share Unit compensation (PSU)

- 50% of stock compensation for the Directors and Executive Officers (including the president) is performance-linked stock compensation.

PSU may fluctuate between 60 to 140% of the standard units according to how close actual results come to mid-term management targets (KPIs) over a three-year period. - The KPIs are the following three items, and the weight of each item is as follows.

| EPS growth rate | The target is 14% average annual EPS growth over the three years of the mid-term management plan with fluctuations between 70% and 130% of the standard units. |

|---|---|

| Relative Total Shareholders Return (r-TSR) | Comparison between the TSR of TOPIX with our TSR (our TSR ÷ TOPIX – TSR) with fluctuations between -5% to 5% of the standard units. |

| ESG evaluation | Evaluation scores of the S&P Global Corporate Sustainability Assessment are used as an index with fluctuations between -5% to 5% of the standard units. |

- Three years' worth of PSU will be vested all at once after the completion of the mid-term management plan.

- Officers who take office or retire in the second or third years of the med-term management plan will be prorated according to the length of time they have served.

Visualization of compensation for Senior Executive Officers (including the president)

* Before redistribution of performance-linked bonuses (30%) based on individual evaluation

Return of Remuneration

In the event of a violation of relevant laws or regulations or internal regulations by the Directors and Executive Officers (including the president), the Board of Directors may decide to reduce future remuneration or refund past remuneration (clawback provision).