Identification of Materiality

Advantest has identified sustainability-related risks and opportunities that may have a material impact on its financial position, business performance, and cash flow, and that could reasonably be expected to influence investor decision-making, with reference to the Sustainability Disclosure Standards issued by the Sustainability Standards Board of Japan (SSBJ).

In conducting the materiality assessment, scenario analysis was partially incorporated in consideration of climate change. As part of the assessment, Advantest reviewed its value chain and compiled a list of sustainability-related risks and opportunities that may be material to Advantest, referencing the SASB (Sustainability Accounting Standards Board) Standards, the European Sustainability Reporting Standards (ESRS) established under the EU Corporate Sustainability Reporting Directive (CSRD), along with other relevant frameworks and standards, as well as the disclosure practices of companies operating in the same industry. The significance of each identified risk and opportunity was evaluated based on its likelihood of occurrence and potential financial impact, through engagement with external stakeholders and discussions with relevant CxOs and departments. The sustainability-related risks and opportunities determined to be material, along with the materiality assessment process, were deliberated at the Executive Management Committee Meeting and reported to the Board of Directors. The materiality assessment is planned to be conducted annually, with specific targets to be incorporated into the Sustainability Action Plan.

Based on the results of our materiality assessment, we have identified the following items as areas of particular importance for our Group.

Sustainability-related Risks and Opportunities

Sustainability Action Plan 2024-2026

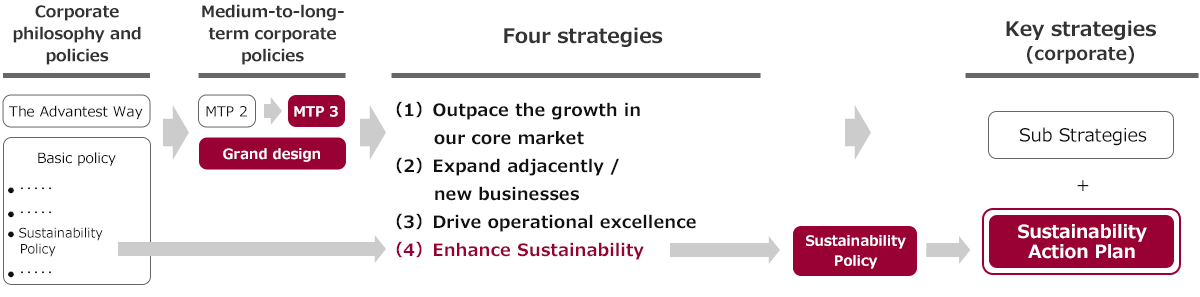

The Mid-Term Management Plan is an initiative to achieve our Grand Design and to continue sustainable growth thereafter. In order to contribute to a sustainable future through our business, we made the four strategies in the third Mid-Term Management Plan, which began in fiscal 2024.

One of the four strategies is "Enhance Sustainability". To promote this, we have set up the Sustainability Policy and formulated the Sustainability Action Plan 2024-2026 as the overall picture of our med-term sustainability initiatives and their respective medium-term targets from 2024 onwards in line with this policy.

In developing a new medium-term sustainability action plan, we have completely reorganised the themes to be addressed to be linked to the Grand Design and the third Med-Term Management Plan (MTP3), from the perspective of increasing the value provided to stakeholders, and have set new medium-term targets for each of these themes. New medium-term targets have been set for each of these themes. In conjunction with this, the name of the plan was changed to better reflect the content and scope of future initiatives. We are currently identifying materiality for the entire Advantest Group in line with the priority themes in the new Sustainability Action Plan 2024-2026.

The Sustainability Reort describes the new Sustainability Action Plan 2024-2026 and reports on the results of our sustainability initiatives to date, based on the ESG Action Plan 2021-2023. Advantest strategically promotes initiatives to achieve the targets set for each issue in the Sustainability Action Plan. Furthermore,The action items and targets in the Sustainability Action Plan are regularly reviewed in accordance with changes in their importance to Advantest.

Sustainability Action Plan 2024-2026 : Targets and Progress

-

*1Please refer to "Management" for the list of CxOs.

-

*2The non-consolidated Female manager ratio is described in the Securities Report under “Item 1. Company Overview 5. Status of Employee.”

-

*3Advantest's qualification system is a 10-level system which is globally standardized, with Level 6 being the highest level of qualification for general employees.

-

*4A group-wide survey is conducted every three years.

-

*5This award system honors employees who embody INTEGRITY through nominations from other employees.

-

*6As the White 500 is a certification system in Japan, the Company and its subsidiaries in Japan are subject to certification.

-

*7GHG emission per AT innovations is calculated by dividing Scope 3 Category 11 GHG emission by AT innovation (number of transistors based on Advantest's market share, pins, frequency, DPS current in systems that account for 80% of annual sales, and number of the systems).

-

*8Tier 1 suppliers, which represent the top 85% of suppliers in terms of transaction value, and Tier 2 suppliers, which are the main suppliers of the Tier 1 suppliers, are subject to due diligence. These suppliers are defined as designated business partners.

-

*9The top 85% of suppliers by transaction value are defined as main business partners.

-

*10A group-wide compliance survey is conducted every three years.

-

*11Considering that not all employees wish to use the internal reporting system, the percentage of employees who answered that they would use the internal reporting system was calculated excluding those who answered ‘I don't know’ regarding the improvement of the convenience of the internal reporting system.